indiana inheritance tax exemptions

In 2021 the credit will be 90 and the tax phases out completely after December 31 2021. This tax ended on December 31 2012.

Indiana Estate Tax Everything You Need To Know Smartasset

The following is a description of how the tax worked for deaths that occurred prior.

. Since most people have a net worth far below this amount you can see why the estate tax impacts so few people. The state income tax rate is 323 and the sales tax rate. The decedents surviving spouse pays no inheritance tax due to an unlimited marital.

However be sure you remember to file the following. 430 pm EST or via our mailing address. IC 6-41-3-1 Exempt transfers Sec.

The amendments made to sections 65 and 7 of this chapter by PL2-1987 take effect on January 1 1987 and apply to taxable years beginning after December 31 1986. Each class is entitled to a specific exemption IC6-41-3-91. Anyone who doesnt fit into Class A or B goes hereincluding for example aunts uncles cousins friends nieces and nephews by marriage and corporations.

Indiana Inheritance and Gift Tax. The item Inheritance tax. Child stepchild parent grandparent grandchild and other lineal ancestor or descendant.

We make no warranties or guarantees about the accuracy completeness or adequacy of the. Inheritance Tax Exemptions and Deductions. Indiana inheritance tax was eliminated as of January 1 2013.

Ie the total value of interest minus the applicable exemption by the appropriate tax rate. Indiana Inheritance Tax Exemptions and Rates. The first inheritance tax law of indiana was passed in 1913.

For more information please join us for an upcoming FREE seminar. The inheritance tax rates are Class A Net Taxable Value Of Property Interests Transferred Inheritance Tax 25000 or less 1 of net taxable value Over 25000 but not over 50000 250 plus 2 of net taxable value over 25000 Over 50000 but not. Code 6-41-3et seq.

So any assets below this level are not subject to the estate tax. Transfers to a spouse are completely exempt from Indiana inheritance tax IC6-41-3-7. However that phase out was accelerated dramatically when the Indiana legislature enacted and Governor Pence signed into law on May 8 2013 the repeal of Indianas Inheritance Tax.

The exemption for the federal estate tax is 1170 million in 2021 and increases to 1206 million in 2022. The affidavit may be used only for a decedent whose taxable transfers to each. Miscellaneous taxes and exemptions represents a specific individual material embodiment of a distinct intellectual or artistic creation found in Indiana State Library.

Last year the Indiana legislature enacted a plan to phase out Indianas Inheritance Tax by the end of year 2021. Connecticut has an estate tax ranging from 108 to 12 with an annual exclusion amount of 71 million in 2021. Indiana may have more current or accurate information.

More information can be found in our Inheritance Tax FAQs. Inheritance Tax Exemptions and Deductions IC 6-41-3-01 Application of certain amendments to chapter Sec. The lowest rate is.

For individuals dying after December 31 2012. Federal estatetrust income tax. It may be used to state that no inheritance tax is due as a result of Decedents death after application of the exemptions provided by Ind.

Indiana Inheritance Tax Exemptions and Rates. In 2022 Connecticut estate taxes will range from 116 to 12 with a 91-million. This item is available to borrow from 1 library branch.

Indiana has a three class inheritance tax system and the exemptions and tax rates vary between classes based on the relationship of the recipient to the decedent. Repeal of Inheritance Tax PL. Each transfer described in section 2055a of the Internal Revenue Code is exempt from the inheritance tax.

205 2013 Indianas inheritance tax was repealed. This phase-out grants those who have died on or after January 1 2013. Does Indiana Have an Inheritance Tax or Estate Tax.

If you have additional questions or concerns about estate planning and taxes contact an experienced Indianapolis estate planning attorney at Frank Kraft by calling 317 684-1100 to schedule an appointment. Up to 25 cash back 7031 Koll Center Pkwy Pleasanton CA 94566. The amount of each beneficiarys exemption is determined by the relationship of that beneficiary to the decedent.

Class A Beneficiaries Exemptions effective 070197. Indiana may have more current or accurate information. Indiana Department of Revenue.

You may also contact DOR via email call us at 317-232-2154 Monday through Friday 8 am. The state of Indiana requires you to pay taxes if youre a resident or nonresident who receives income from an Indiana source. Indiana used to impose an inheritance tax.

No inheritance tax returns Form IH-6 for Indiana residents and Form IH-12 for nonresidents have to be prepared or filed and no tax has to be paid. No inheritance tax returns Form IH-6 for Indiana residents and Form IH-12 for nonresidents have to be prepared or filed. Transfers to a spouse are completely exempt from Indiana inheritance tax IC6-41-3-7.

However other states inheritance laws may apply to you if someone living in a state with an inheritance tax leaves you money or property. Final individual federal and state income tax returns each due by tax day of the year following the individuals death. Transfers to a spouse are completely exempt from Indiana inheritance tax IC6-41-3-7.

The Iowa tax only applies to inheritances resulting from estates worth more than 25000. There is no inheritance tax in Indiana either. In Maryland the tax is only levied if the estates total value is more than 30000.

In addition no Consents to Transfer Form IH-. Indiana does not have an inheritance tax nor does it have a gift tax. For deaths occurring in 2013 or later you do not need to worry about Indiana inheritance tax at all.

IC 6-41-3-65 Annuity payments Sec. As a result Indiana residents will. But just because the inheritance taxes didnt change in 2020 doesnt mean state legislatures wont change them going forward.

The IRS did however change the federal estate tax exemption from 2018 to 2019 from 1118 million to 114 million. Each heir or beneficiary of a decedents estate is divided into three classes. Brother Sister Niece Nephew Daughter-In-Law Son-In-Law First 500 is exempt from tax.

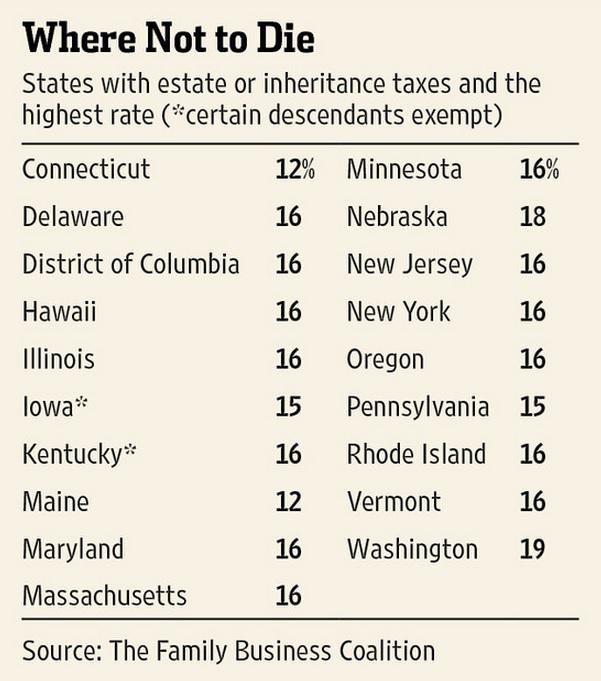

Estate tax rates vary from state to state. Indiana levies no state taxes on the inheritance or estates of residents and nonresidents who own property there. The federal government gives you an exemption of 117 million for tax year 2021.

Indiana state income tax rate is 323.

State Estate And Inheritance Taxes

State Estate And Inheritance Taxes Itep

Indiana Estate Tax Everything You Need To Know Smartasset

State Death Tax Is A Killer The Heritage Foundation

The Federal Estate Tax A Critical And Highly Progressive Revenue Source Itep

Indiana Estate Tax Everything You Need To Know Smartasset

New York S Death Tax The Case For Killing It Empire Center For Public Policy

The Death Tax Taxes On Death American Legislative Exchange Council

Calculating Inheritance Tax Laws Com

New York S Death Tax The Case For Killing It Empire Center For Public Policy

States With No Estate Tax Or Inheritance Tax Plan Where You Die

State Estate And Inheritance Taxes Itep

How Do State Estate And Inheritance Taxes Work Tax Policy Center

State Estate And Inheritance Taxes Itep

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Does Indiana Have An Inheritance Tax Indianapolis Estate Planning Attorneys

States With No Estate Tax Or Inheritance Tax Plan Where You Die

How To Avoid Estate Taxes With A Trust

How Is Tax Liability Calculated Common Tax Questions Answered